Watching out for the ultimate tail event

<For accredited investors only>

The ultimate negative tail event for an investor is the permanent impairment of capital (or even say significant long-term decline in investment value, since permanence can be indefinitely debated). Discerning allocators in equity strategies should accordingly use empirical evidence to assign probabilities to potential tail events.

The chief purpose of this post is to debunk a prevalent myth that permanent/significant loss of capital is least likely in India’s most liquid large-cap portfolio sets (say Nifty50, for instance), while small-cap strategies are generally characterized otherwise with a lazy sweep.

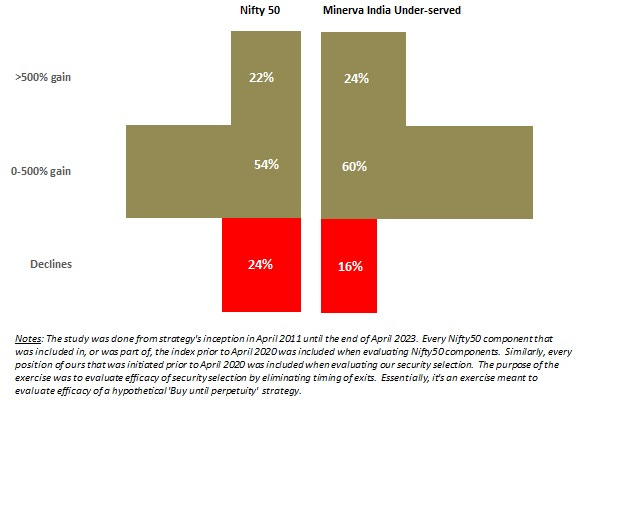

It’s well established that fortuitous timing of exits inevitably plays a key role in certain portfolio performance outcomes. From a discerning allocator’s viewpoint though, these should be mostly disregarded. Instead, any historical stock purchase within any strategy should be evaluated to confirm if such a purchase would have been accretive over long-term holding periods (defined as >3 yrs for this exercise), when price discovery is likely to be relatively efficient. The attached exhibit shows distribution of gains/losses for all Nifty50 components and our holdings, given the following constraints - Every Nifty50 component (in case of Nifty50 on the left of the exhibit) was part of the index at some point between April 2011 and April 2020. Similarly, every holding of ours (in case of our book on the right of the exhibit) was initiated between our inception and April 2020. This constraint was placed so that we have a meaningful holding time period (>3 years) to evaluate efficacy of security selection. The idea is to make us and Nifty50 accountable for every security choice from the outset, regardless of whether the timing of the exit in our case or index exclusion in case of Nifty50 was eventually favorable. Essentially, if we ever initiated a position, we should be held accountable if in 3+ years it has lost any capital, regardless of whether we had already exited or not. Ditto for India’s much admired “blue chip” set.

The results confirm that, in sharp contrast to deeply entrenched beliefs around smallcaps, our return distribution is significantly more favorable than that of Nifty50. Over 12+ years of deploying capital in India, not only have we identified more multi-baggers than Nifty50, but more importantly, just about 16% of our holdings have reported declines (from our entry until the end of April 2023, regardless of whether we exited the position or not), vs. nearly 1/4th of all Nifty50 components.

Please reach out to Sourav Dutta to request more information on our security selection across timeframes of your choice.